7 Scams to Watch Out for in 2024

Posted On: August 21, 2024 by The Middlefield Banking Company in: Cybersecurity General

As technology evolves, so do the tactics of scammers. In 2024, it’s more important than ever to stay vigilant and protect yourself from financial fraud. Here are 7 scams to watch out for in 2024, along with tips on how to identify and avoid them.

1. AI-Powered Scams

Scammers are increasingly using artificial intelligence (AI) to create convincing phishing emails, deepfake videos, and voice messages. These AI-generated scams can impersonate friends, family, or even employers to trick you into sharing personal information or sending money.

How to Avoid: Be skeptical of unexpected messages, even if they appear to come from someone you know. Verify the sender’s identity through a different communication channel before taking any action.

2. Student Loan Forgiveness Scams

With ongoing changes in student loan forgiveness programs, scammers are taking advantage of the confusion. They may pose as government officials or create fake application sites to steal your personal information.

How to Avoid: Always go directly to the official Department of Education website for information on student loan forgiveness. Remember, applying for forgiveness is free, and the government will not contact you by phone to request personal information.

3. Cryptocurrency Scams

Cryptocurrency remains a popular target for scammers. They may offer fake investment opportunities, create fraudulent exchanges, or impersonate legitimate companies to steal your funds.

How to Avoid: Research any cryptocurrency investment thoroughly. Use reputable exchanges and never share your private keys or personal information with anyone.

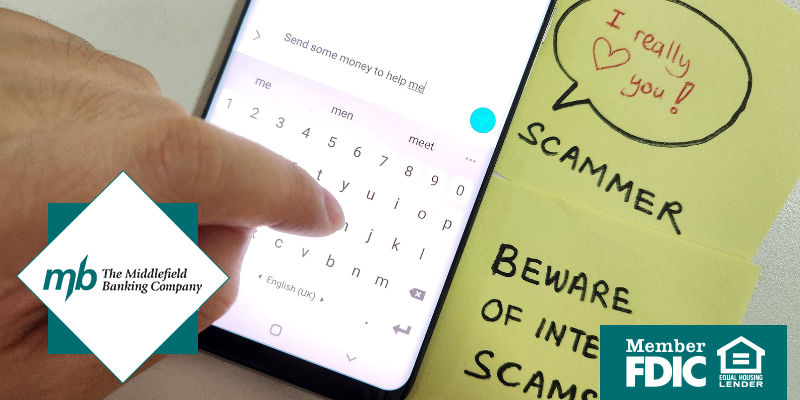

4. Romance Scams

Scammers often exploit emotions by posing as potential romantic partners on dating sites and social media. They build trust over time and then ask for money, often claiming to be in an emergency.

How to Avoid: Be cautious of anyone who quickly professes love or asks for money. Verify their identity and be wary of sharing personal information with someone you haven’t met in person.

5. Employment Scams

Job seekers are targeted with fake job offers that require upfront payments for training or equipment. Scammers may also steal personal information through fake job applications.

How to Avoid: Research the company and job offer thoroughly. Legitimate employers will not ask for money upfront. Use official company websites to verify job postings.

6. Fake Charity Scams

Scammers exploit people’s generosity by creating fake charities, especially during times of crisis or natural disasters. They may use high-pressure tactics to solicit donations.

How to Avoid: Verify the charity’s legitimacy through organizations like Charity Navigator or the Better Business Bureau. Avoid making donations through unsolicited calls or emails.

7. Online Account Tax Scams

Scammers may send emails or texts claiming there is an issue with your tax account, prompting you to click on a link and provide personal information.

How to Avoid: The IRS will never contact you via email or text to request personal information. Always go directly to the official IRS website for any tax-related issues.

Protect Yourself with the Middlefield Bank App

One of the best ways to protect yourself from scams is to monitor your accounts regularly. The Middlefield Bank app provides 24/7 access to your account balances, transaction history, and real-time alerts on account activity. With features like mobile deposit and digital payments, you can manage your finances securely from anywhere.

Start the enrollment process for online banking here: Online Banking Enrollment (middlefieldbank.bank)

Download the App

- For Apple phone users: MB Mobile Banking App on the App Store (apple.com)

- For Android phone users: MB Mobile Banking App - Apps on Google Play

By staying informed about the latest scams and using tools like the Middlefield Bank app to monitor your accounts, you can protect yourself and your finances in 2024 and beyond.

0 comments